Know more about NPV VS IRR Formula in Excel

Conflict between NPV and IRR

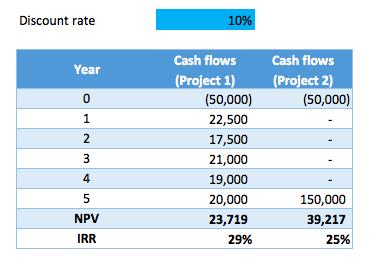

NPV VS IRR Formula in Excel will provide the same indicator of the decision of accept or rejection of the project. However, NPV and IRR may provide conflicting results while comparing two or more projects.

For instance, one may show a higher NPV while the other has a higher IRR and vice versa. This difference occurs due to the different cash flow patterns in the two projects.

Example:

An example of this conflicting situation is given below.

- NPV Formula Calculation

- IRR Formula Calculation

- When a company faces this type of situation, they should choose the project that has the higher NPV. This is because there is an inherent reinvestment assumption. In other words, there is an assumption in our calculation that the cash flows will be reinvested at the same discount rate used in the calculation.

- For NPV, the implicit reinvestment rate assumption is 10%. However, in IRR, the implicit reinvestment rate assumption is 29% or 25% between the two investments.

- The reinvestment rate of 29% or 25% in IRR is high and unrealistic when we compare it to the NPV. This makes the NPV results superior to the IRR results. In this example, project 2 should be chosen.

I hope that helps. Please leave a comment below with any questions or suggestions. For more in-depth Excel training, checkout our Ultimate Excel Training Course here. Thank you!

0 Comments