Accounting for Capital and Intangible Assets (Canadian GAAP)

Develop your knowledge on capital and intangible assets under Accounting Standards for Private Enterprises (ASPE) under Canadian GAAP.

Limited Time COVID-19 Half Price Special

$99 $49 USD

$179 $79 USD

Capitalize vs. Expense

Learn which costs to capitalize as an asset and which to record as an expense

Capitalize vs. Expense

Learn which costs to capitalize as an asset and which to record as an expense

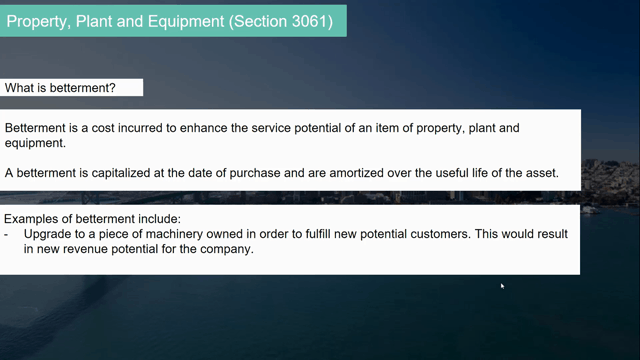

Betterment

Understand when the betterment criteria is applicable to capitalize costs to assets

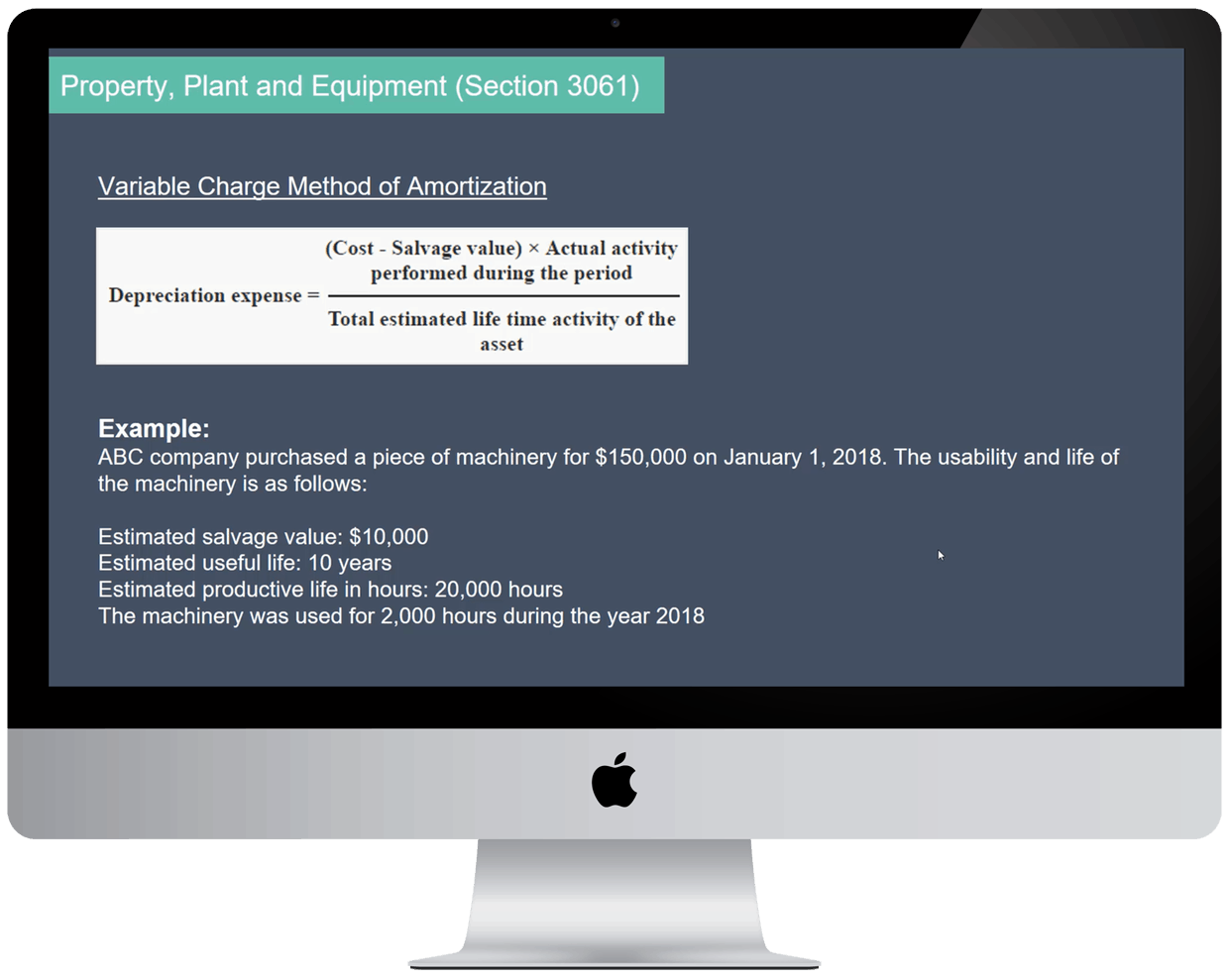

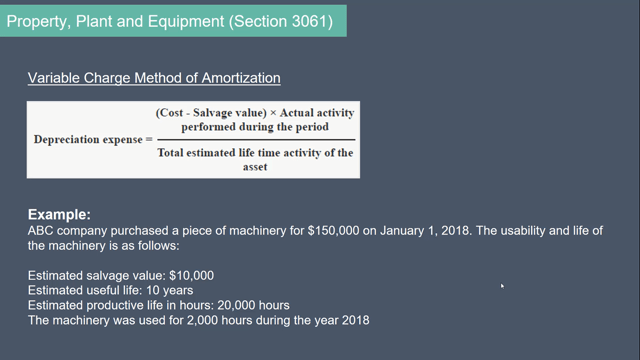

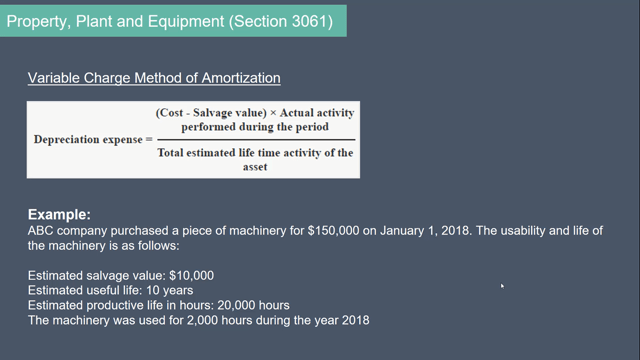

Amortization

We review various amortization methods for depreciating capital assets under ASPE

Amortization

We review various amortization methods for depreciating capital assets under ASPE

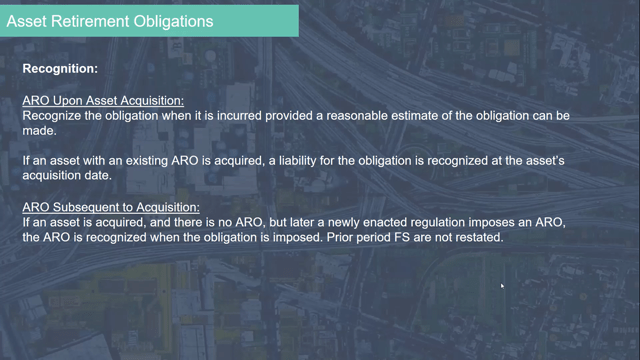

Asset Retirement Obligations

Learn how to record asset retirement obligation assets and liabilities and amortize them over the life of the related asset.

Course Preview

Trusted Experience from the World’s Top Companies

Full Course Outline

Part 1: Introduction to Capital and Intangible Assets under Canadian GAAP

Part 2: What is Property, Plan and Equipment

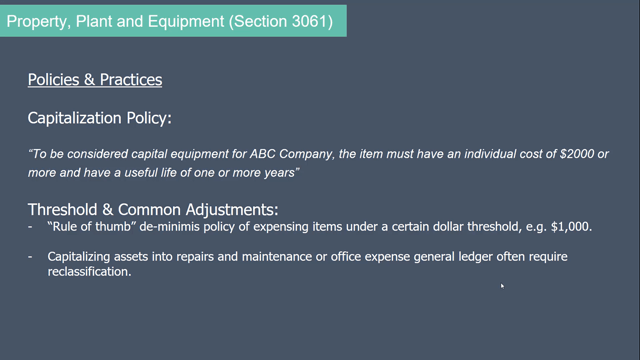

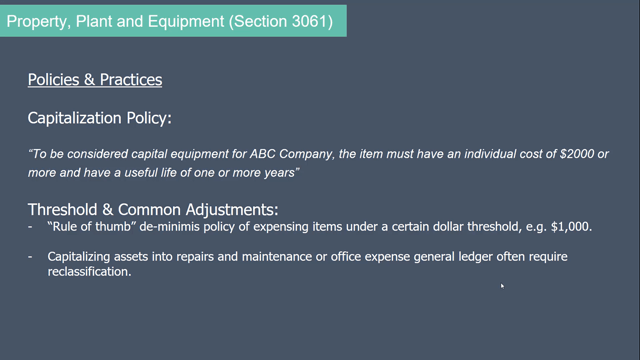

Part 3: Policies, Practices, Recognition

Part 4: Betterment

Part 5: Subsequent Measurement

Part 6: Amortization Methods

Part 7: Impairment

Part 8: Intangible Assets

Part 9: Goodwill

Become a Canadian GAAP Expert

Join 50,000+ students who have enrolled in our online courses to advance their career!

Contact Us

Please reach out to us with questions and comments using the form.

Commerce Curve.