Accounting for Income Taxes (Canadian GAAP)

Develop your knowledge on income taxes under Accounting Standards for Private Enterprises (ASPE) under Canadian GAAP. This course includes an hour of lessons on Canadian tax rates, association rules, personal service businesses, methods of accounting for income taxes, financial statement presentation and investment tax credits.

Limited Time COVID-19 Half Price Special

$99 $49 USD

$179 $79 USD

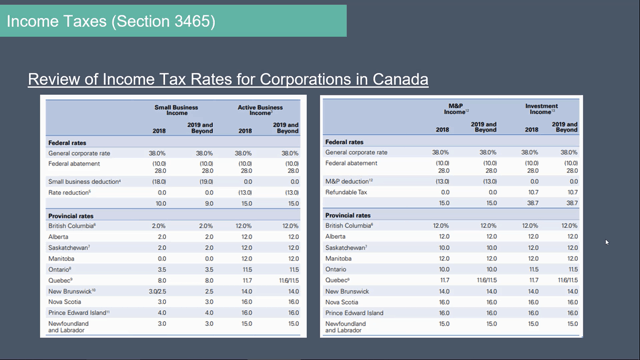

Canadian Tax Rates

Learn the different tax rates for small businesses, active business income for CCPC’s, MP&, and investment income.

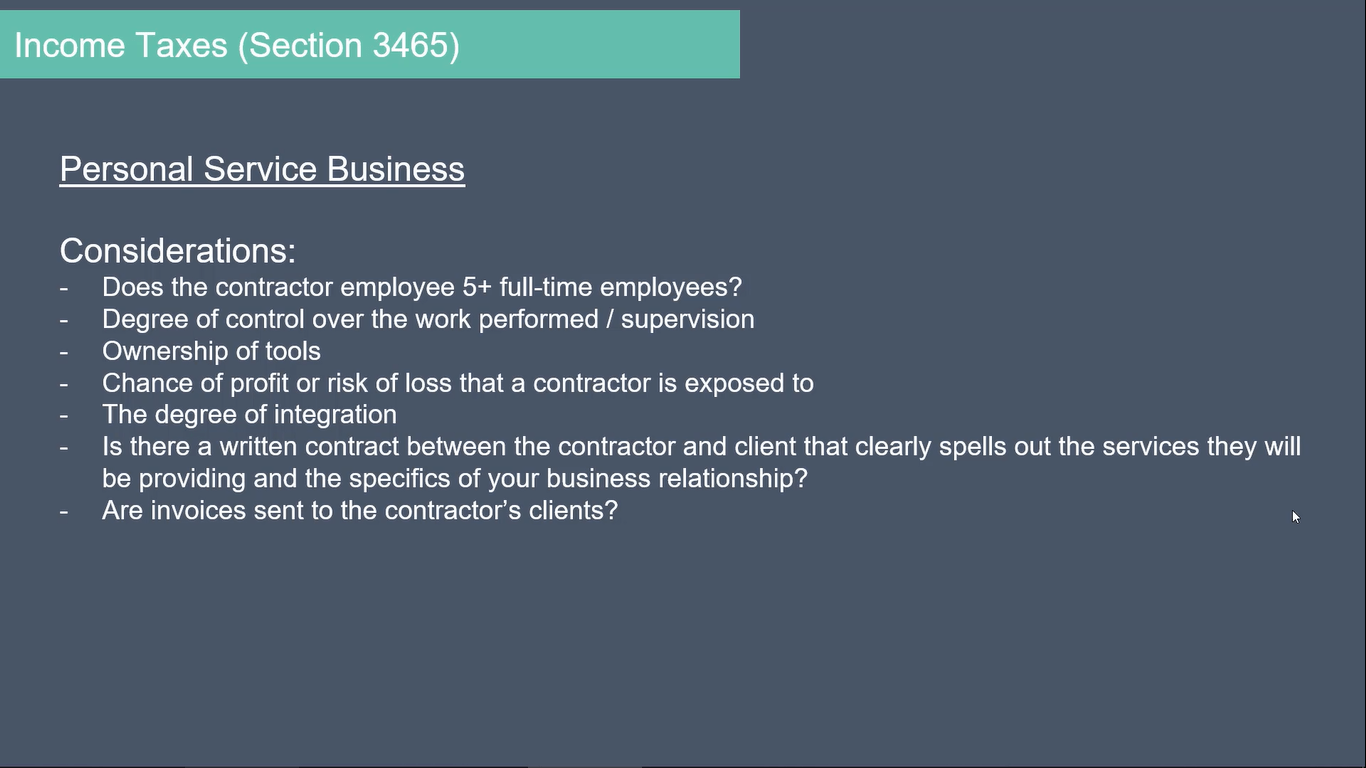

Personal Service Business

Understand the rules regarding personal service businesses which restrict incorporation of individuals as a tax reduction scheme.

Personal Service Business

Understand the rules regarding personal service businesses which restrict incorporation of individuals as a tax reduction scheme

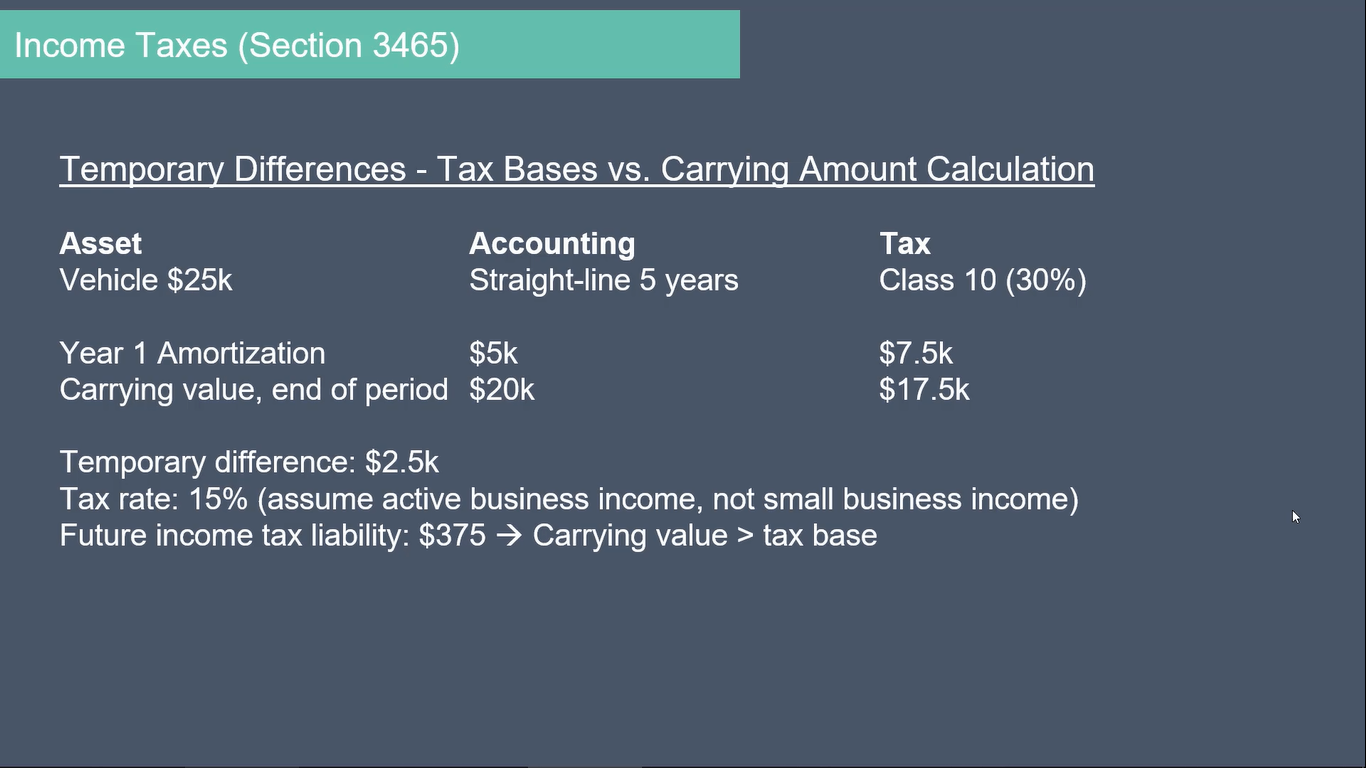

Future Income Tax Assets and Liabilities

We’ll review how temporary differences between accounting and tax treatments lead to future income tax assets and liabilities.

Course Preview

Trusted Experience from the World’s Top Companies

Full Course Outline

Part 1: Introduction to Income Taxes under Canadian GAAP

Part 2: What is Income Tax and Tax Rates in Canada

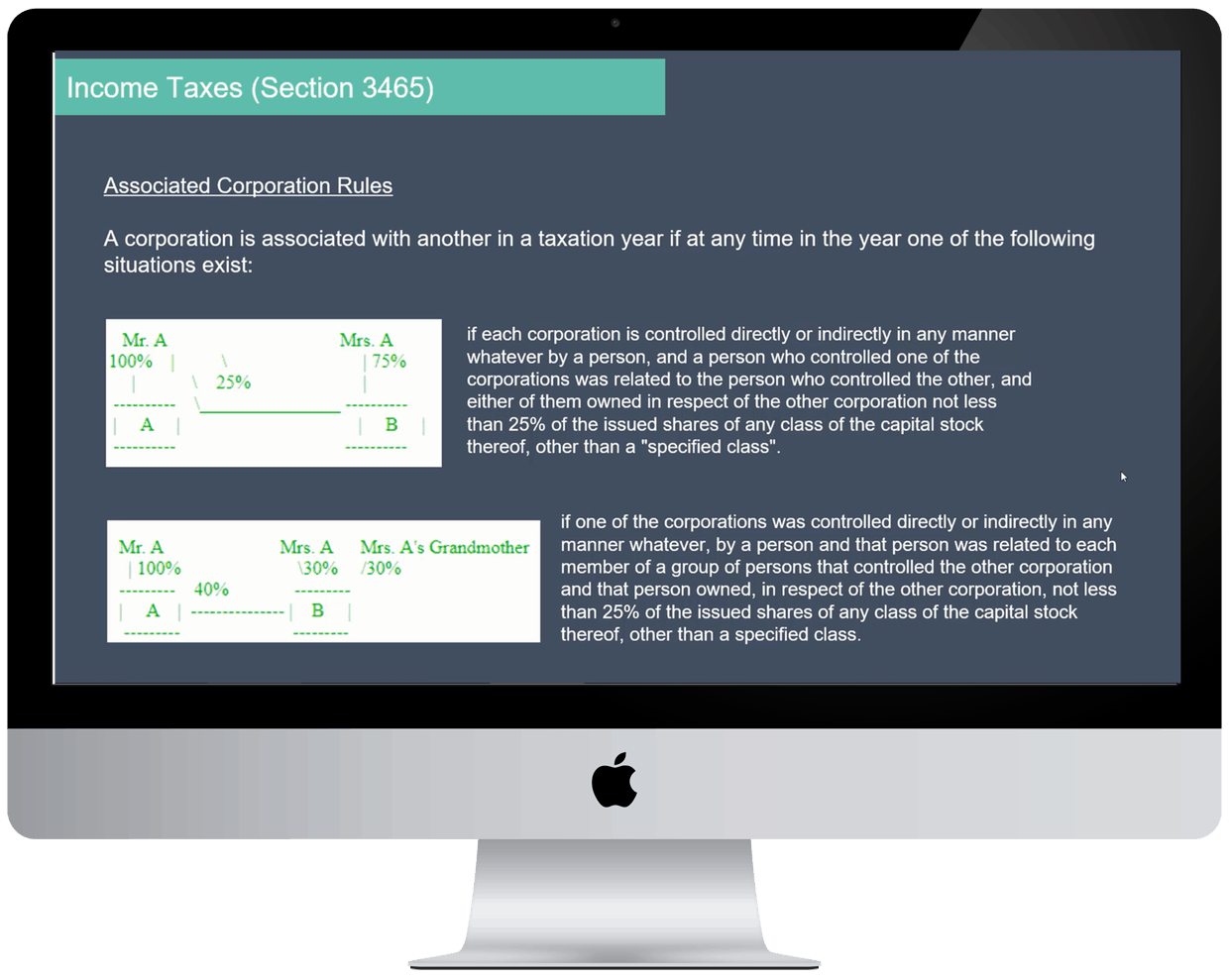

Part 3: Association Rules

Part 4: Personal Service Business

Part 5: Income Tax Rates

Part 6: Methods of Accounting for Income Taxes

Part 7: Financial Statement Presentation

Part 8: Investment Tax Credits

Become a Canadian GAAP Expert

Join 50,000+ students who have enrolled in our online courses to advance their career!

Contact Us

Please reach out to us with questions and comments using the form.

Commerce Curve.