Accounting for Revenue and Related Party Transactions (Canadian GAAP)

Develop your knowledge on revenue and related party transactions under Accounting Standards for Private Enterprises (ASPE) under Canadian GAAP.

Limited Time COVID-19 Half Price Special

$99 $49 USD

$179 $79 USD

Revenue Recognition Criteria

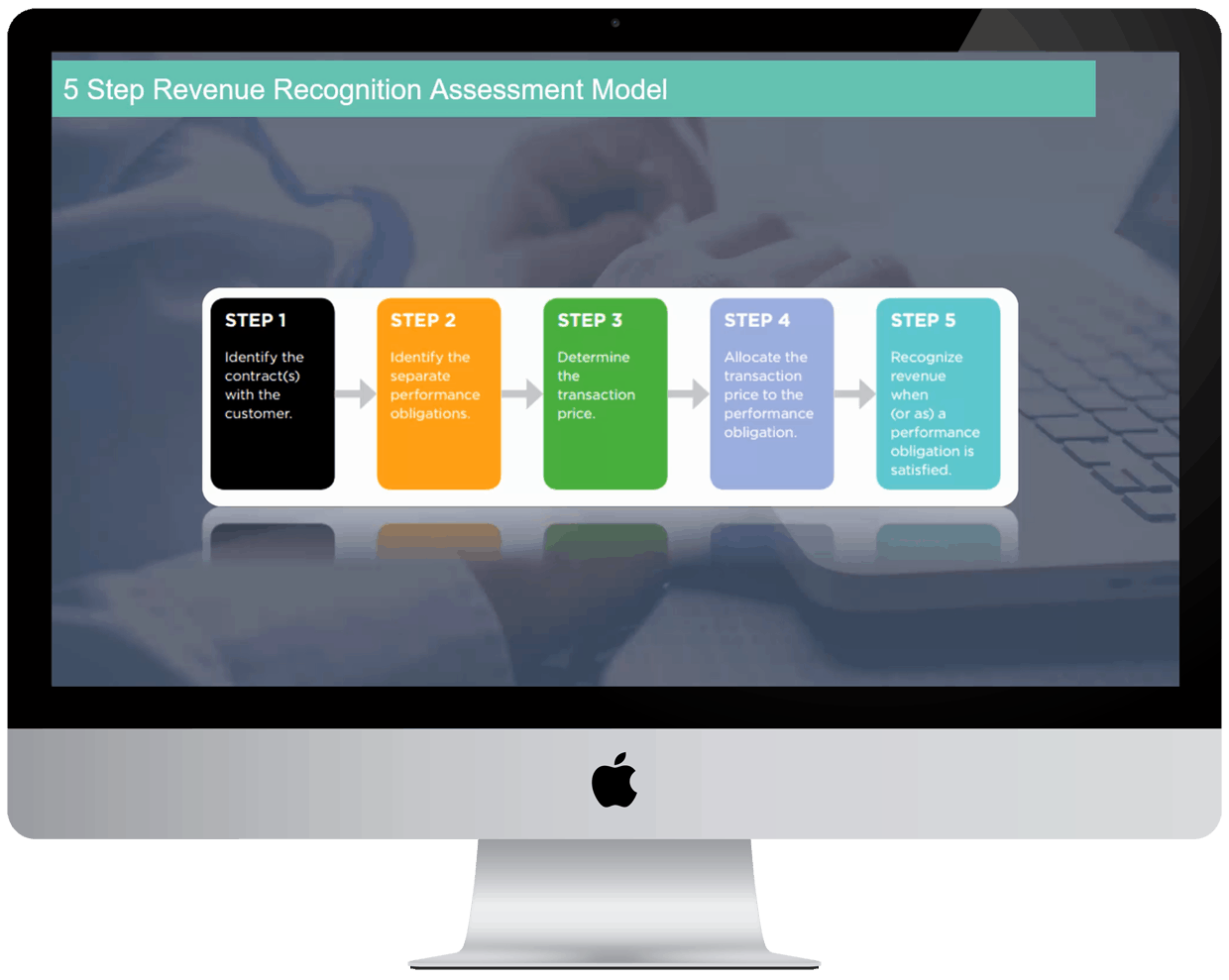

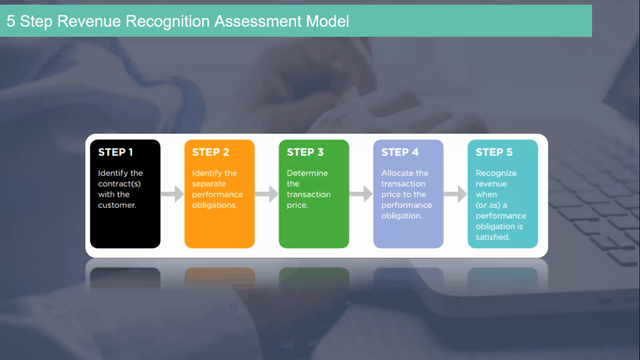

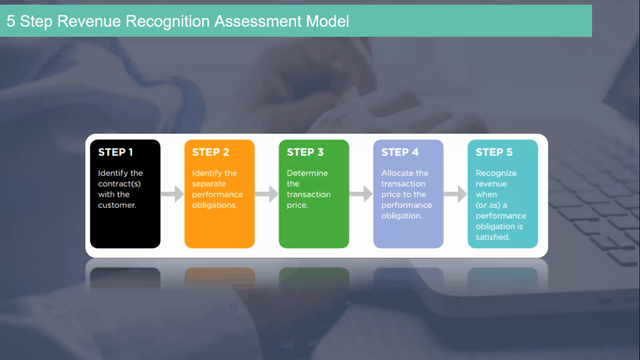

Learn the 5 step revenue recognition criteria assessment model

Revenue Recognition Criteria

Learn the 5 step revenue recognition criteria assessment model

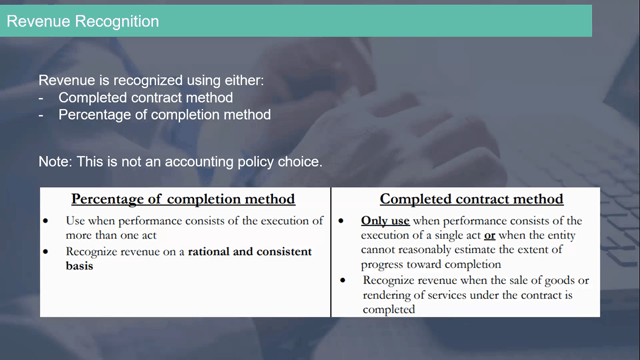

Percentage of completion vs. completed contract methods

Understand when and how to apply the percentage of completion and completed contract method.

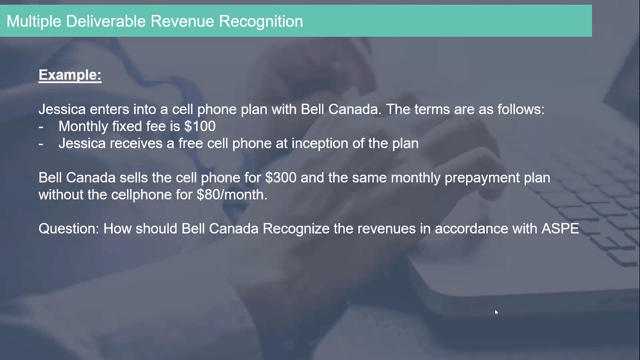

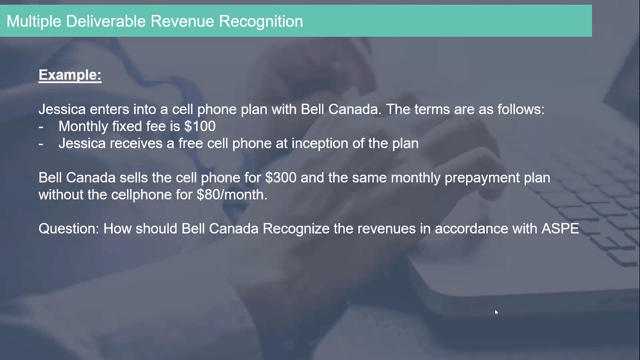

Multiple Deliverables

Learn the revenue recognition criteria for multiple deliverable arrangements.

Multiple Deliverables

Learn the revenue recognition criteria for multiple deliverable arrangements.

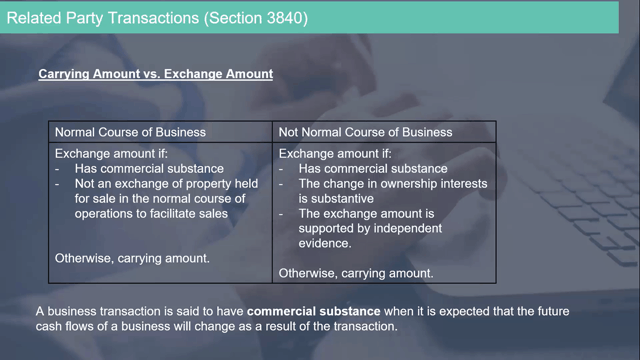

Related Party Transactions

Understand how to account for related party transactions which may or may not be in the normal course of operations.

Course Preview

Trusted Experience from the World’s Top Companies

Full Course Outline

Part 1: Introduction to Revenue and Related Party Transactions

Part 2: What is Considered Revenue?

Part 3: Measurement Criteria

Part 4: Step Revenue Recognition Assessment Model

Part 5: Revenue Recognition

Part 6: Revenue Recognition Examples

Part 7: Gross vs. Net

Part 8: Other Income

Part 9: Multiple Deliverables

Part 10: Presentation Requirements

Part 11: Related Party Transactions

Become a Canadian GAAP Expert

Join 50,000+ students who have enrolled in our online courses to advance their career!

Contact Us

Please reach out to us with questions and comments using the form.

Commerce Curve.