How to Use the DEPRECIATION (DB) Formula in Excel

DEPRECIATION (DB) Formula in Excel is used to return the depreciation of an asset for a specified period using the fixed-declining balance method.

Formula Explanation

- Cost (required): The historical cost of the asset.

- Salvage (required): The value of the asset at the end of the depreciation period (salvage value of the asset).

- Life (required): The number of periods over which the asset is being depreciated (i.e. this is the useful life of the asset).

- Period (required): The period for which you want to calculate the depreciation. Periods must use the same units as life. E.g. if you use years for life, you should use years for a period.

- Month (optional): The number of months in the first year. If the month is omitted, it is assumed to be 12 months.

Example:

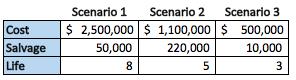

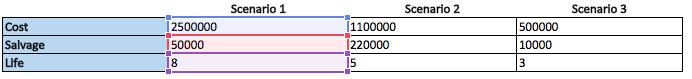

Johnson & Co. purchase 3 pieces of equipment for its business at the cost, useful life, and salvage values noted below.

Calculate the depreciation per year using the DB formula in Excel.

Solution:

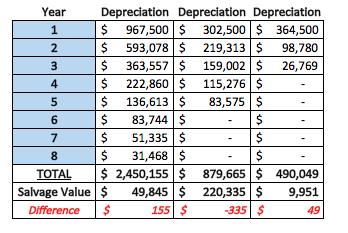

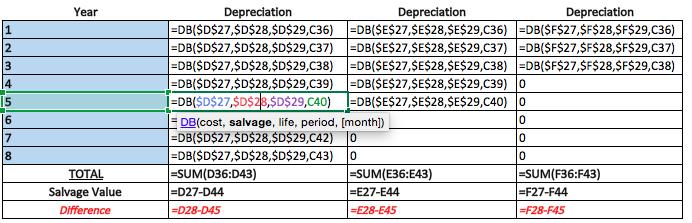

Using the DB formula in excel, we can calculate the amount of depreciation per year for each of the 3 scenarios using the declining balance method.

Formula Implementations:

- You cannot actually put a zero in the salvage value syntax as it is going to depreciate the whole amount in year 1.

- We have to rather estimate a salvage value of $1 at the end of the useful life in order for the formula to take into consideration that the asset should be depreciated over a number of years and not just 1 year.

I hope that helps. Please leave a comment below with any questions or suggestions. For more in-depth Excel training, checkout our Ultimate Excel Training Course here. Thank you!

0 Comments